The tariff compounding aspect detailed in this article has barely, if ever, been reported. However, it is real. Tariff compounding is not price gouging. It will affect all products imported into the United States. Please share, and if you are or know a journalist, pass this article on to them to report.

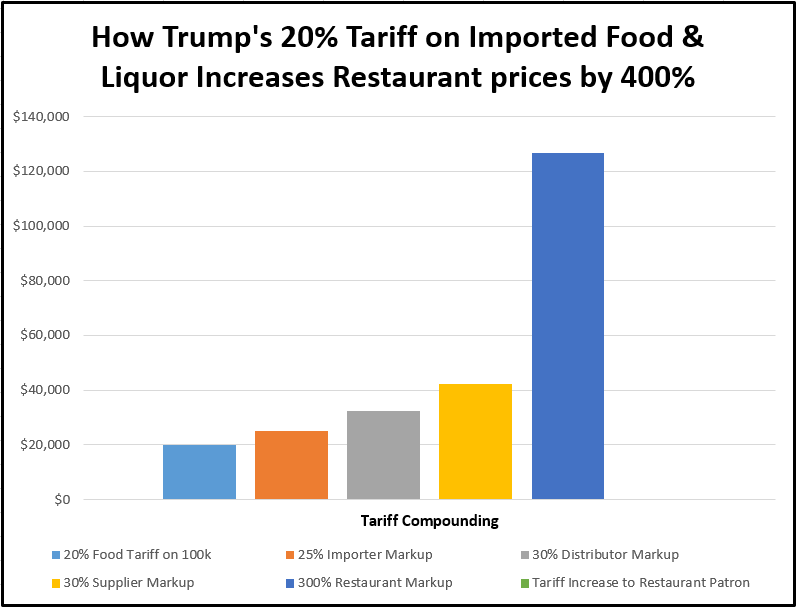

To help the hospitality industry (hotels, restaurants, bars, nightclubs, catering, etc.) understand the potential impact of a proposed 20% tariff on imported food and liquor products by Trump, real-world examples are given. These examples demonstrate how a 20% tariff on imported products can increase the selling price of food, beer, wine, and liquor by 300% to 400% (tripling or quadrupling menu item prices).

This document explores the various purchase chains (food and booze differ) and how tariffs compound through each financial transaction. The impact on restaurant and bar pricing, markup strategies, cost of sales (COS) percentages for food, beer, wine, and liquor and the final price impact on patrons are discussed.

Overview of How Tariffs Affect the Hospitality Industry

When the U.S. imposes a 20% tariff on imported goods, it indirectly affects restaurants, bars, hotels, and catering companies. These businesses do not import products directly but purchase from suppliers dealing with importers, distributors, or state-controlled liquor boards.

The 20% tariff cost is passed on and through the entire supply chain. Each party (importer, distributor, supplier, liquor control board) adds their profit margin (typically 20% to 30%). Note their gross selling cost includes the tariff portion. This causes tariff compounding, meaning the overall tariff cost grows at 20%, 30% to 40% or more for each separate financial transaction.

Note that tariff and excise taxes are paid by the importer at the port of landing (the USA). At no time does the exporting company pay the tariff. As such, Trump’s statement that he made billions on tariffs from China is absolutely wrong – the initial tariffs are paid by the USA importing company and these extra costs are passed forward to all transactions in the buy/sell chain.

Tariffs are collected when products arrive in the destination country. The USA Importer pays the tariff fee. Exporting countries pay nothing. For a $100k purchase, the importer must pay a $20k tariff tax before goods are released. The cost for the product therefore increases by 20%. As such, the importer passes on their total cost (now $120,000) – plus their markup – to their distributors, who in turn pass on their total cost (which now includes the compounded tariff portion) and their markup to their suppliers, who again repeat this same process and then sell their product to a hotel, bar, or restaurant, which then adds their profit markups. Quite simply, end patrons of restaurants pay all costs related to tariff compounding.

At each stage, entities in the supply chain mark up the cost of goods, which includes the compounded tariff. By the time the restaurant or bar buys the product, the tariff has vastly multiplied beyond the original 20%. After that, the hospitality businesses apply their own markups (e.g., 3 times for food and beer for a 33% cost of sale, 2 times for wine for a 50% cost of sale, and 4 to 5 times for a poured cost of sales at 20% to 25%), further inflating the final price paid by the restaurant/bar patron.

Common Chains of Transactions That Compound Tariff Effects

1. Food Supply Chain

The process of importing food products involves multiple transactions:

-

- Step 1: Importer purchases from an overseas supplier and pays the 20% tariff upfront. The importer adds a markup to the total cost that includes the tariff.

- Step 2: Distributor buys from the importer at the tariff-inflated price and applies their 30% markup.

- Step 3: Supplier buys from the distributor and adds an additional 20% markup.

- Step 4: The restaurant or bar purchases from the supplier and applies its own markup, typically 2x-5x.

At each stage, the tariff is compounded. By the time the product reaches the restaurant, the compounded tariff has inflated the price far beyond the original 20%.

Example:

-

- Initial cost of imported food: $100,000

- Tariff (20%): $20,000

- Price paid to importer: $120,000

- Importer markup (20%): $120,000 × 20% = $24,000

- Price to distributor: $144,000

- Distributor markup (30%): $144,000 × 30% = $43,200

- Price to supplier: $187,200

- Supplier markup (20%): $187,200 × 20% = $37,440

- Price to restaurant: $224,640

The restaurant applies its markup to achieve its desired cost of sales (32% – 35% for food).

-

- Restaurant markup (3x): $224,640 × 3 = $673,920

After the restaurant marks up their product, the tariff portion grows from $20,000 to $112,320 due to compounding (a 461% inflationary increase).

In addition, the original product cost of $100,000 grows to $673,920, a 573.92% increase due to tariff and profit compounding. Note that without the tariff, costs would be the same since the profit-taking process always occurs. In summary, it is only the tariff cost increase that is responsible for the 100% of the price increase.

2. Liquor Supply Chain with State Liquor Control Boards

For liquor, the process is slightly different, as State Liquor Control Boards often adding a layer of complexity:

-

- Step 1: Importer buys liquor and pays the 20% tariff.

- Step 2: Importer applies a 25% markup.

- Step 3: Distributor buys from the importer and applies a 30% markup.

- Step 4: State Liquor Control Board buys the product and applies a markup of 20%-40%.

- Step 5: The product is sold to restaurants and bars, which then apply a four to five times price markup.

Real-World Example of Tariff Compounding on a Mixed Drink

Let us assume the original cost of a bottle of imported liquor before tariffs is $100.

-

- Importer’s Cost and Tariff Application:

- Initial cost of liquor: $100

- Tariff (20%): Adds $20

- Cost after tariff: $120

- Importer’s markup (25%): $120 × 25% = $30

- Cost to distributor: $150

- Distributor’s Markup:

- Distributor’s markup (30%): $150 × 30% = $45

- Cost to State Liquor Control Board: $195

- State Liquor Control Board’s Markup:

- Markup (30%): $195 × 30% = $58.50

- Cost to restaurant/bar: $253.50

- Restaurant/Bar Markup:

- Assuming the 26 oz bottle delivers 25 1 oz portions (1 oz is wasted due to spillage):

- Cost per shot (before markup): $253.50 ÷ 25 = $10.14 per shot

- With a 4x markup (20% cost of sale), the price per mixed drink becomes: $10.14 × 4 = $40.56

- With a 5x markup (25% cost of sale), the price per mixed drink becomes: $10.14 × 5 = $50.70

- Importer’s Cost and Tariff Application:

Percentage Increases Due to Compounding and price impact to bar / restaurant patrons:

-

-

- Initial tariff amount: $20

- Final compounded tariff portion: $253.50

- The cost increase of 153.5% is specifically due to tariff compounding.

- Final price to the consumer: Due to liquor markup on poured drinks (4 to 5 times markup), the consumer pays $40.56 to $50.70 per mixed drink, representing an overall price increase of 305% to 407% from the original bottle cost without tariffs.

-

Impact on a Restaurant / Bar Patron

For a mixed drink containing imported liquor, the compounding effect of the 20% tariff and multiple markups means the patron experiences a 305% – 407% price increase from the original liquor cost. However, many drinks only contain one or two imported ingredients. As such, the overall price of a drink that contains other non-imported liquors does not triple or quadruple the retail price. For imported beer and wine, the cost is easier to calculate for an imported bottle of beer, draft, bottle or glass wine is simple.

For food menu items that contain only a few imported ingredients (such as a rack of New Zealand lamb with saffron rice), it does not affect the entire cost of a meal. However, “main entree” or “costly” imported items do. For example, if the main entree ingredient is imported (such as lobster or Wagyu beef), since it is the main cost of the meal (being 60% to 70% of the meal), the tariff cost increase is large.

Note that without the tariff, costs would be the same since the profit taking process always occurs. Of importance, only the compounding tariff cost is responsible for the price increase.

In summary, if a patron purchased 25 1oz shots of imported liquor, the new cost is now $253.50 more, representing a 300% to 400% inflation increase that is specifically due to the 20% tariff.

Blame Only the Person that Generated the Tariff:

Do not blame the importer, distributor, supplier, or the hospitality outlet. Other than the hospitality outlet, each vendor has a 70% maximum cost of sales, leaving only 30% to cover their overheads, warehouse space and labor to make a profit. Do not blame the hospitality outlet, as they must maintain a 20%-25% pour cost, a 32%-35% food and beer cost, and a 50% wine cost. They need to maintain these cost of sales percentages since their labor cost runs 35% or more. Hospitality outlets strive for a 65% gross cost that includes products and labor. With overhead, most hospitality outlets do not even make a 10% profit.

The average or median profit margin for restaurants and bars can vary widely based on factors like location, type of establishment, and operational efficiency. However, industry benchmarks can provide general guidance:

Average Profit Margin of HRI Outlets:

-

- Full-Service Restaurants: Typically, the average profit margin ranges between 3% to 6%.

- Quick-Service/Fast Food Restaurants: The average is slightly higher, generally between 6% to 9%.

- Bars/Pubs: Bar profit margins are generally higher than restaurants due to higher margins on alcohol sales. They can range from 10% to 15%, although this can vary depending on factors like location and pricing strategy.

Key Factors Impacting Profit Margins:

-

- Food and Beverage Costs: For restaurants, food costs usually make up about 28% to 35% of total sales, while beverage costs can be lower.

- Labor Costs: Labor is often the largest expense, generally taking up 20% to 35% of revenues.

- Location and Rent: Urban areas with high rent can significantly reduce profit margins.

- Operational Efficiency: Effective inventory management, staffing, and waste reduction all affect profitability.

- Alcohol Sales: Bars benefit from higher margins on alcohol, especially cocktails and beer, which can significantly boost profitability.

The median profit margin for most restaurants typically hovers around 5% overall.

Conclusion:

The 20% tariff on imported food and liquor dramatically impacts the final prices that restaurants, bars, and ultimately the price their patrons pay (China nor any other exporting country pays a single penny). Since tariffs are compounded through the multiple layers of the supply chain, the final price far exceeds the original tariff cost, especially for liquor, where state liquor control boards and high restaurant markups further inflate prices. By understanding this compounding effect, hospitality professionals can better prepare for the financial impact and adjust menu-pricing strategies accordingly.

Note that Supermarkets like Walmart perform their own importing. They also perform their own distribution to regions. Each region requires a warehouse, staff, management, etc. Overall, supermarket pricing will increase by about 70% to 100% for imported goods (price is 1.7 or 2 times the non-tariffed cost).

If you think 9% inflation was bad… Just wait

It is going to get a lot worse. For imported foods in supermarkets, expect 70% inflation due to tariffs all year round. Note the tariff compounding also impacts the USA manufacturing industry.

In the winter, when the USA relies on produce from Mexico, imported produce from Mexico will double. Also, for all products sourced from China, with a 60% Trump tariff, if three compounding transactions (where each separate buy/sell transaction marks up their cost by 30), the $60k original tariff on a $100,000 import transaction balloons as follows:

China 60% Tariff Compounding:

Importer First transaction ($60,000 X 1.3) = $78,000

Distributor Second transaction ($78,000 X 1.3) = $101,400

Supplier Third Transaction ($101,400 X 1.3) = $131,820

Inflation Rate of a 60% Tariff = 119.7% increase ((new tariff cost – original tariff cost) / original tariff cost) * 100

EG: ((131820 – 60000) / 60000) * 100

When dining out at restaurants and eating menu items using imported ingredients, or when going to a bar and ordering a shot of imported liquor, expect a 300% to 400% inflation cost due to the 20% tariffs.

Finally, note the only good news is that many imported products can be substituted for USA products. However, many ingredients like coffee or saffron cannot be duplicated. Note that a major downside is that USA businesses that grow or make their own “substitute” products understand that their product becomes far less costly than imported goods. As such, they will raise their prices to be only slightly lower than tariffed goods (no business wants to leave money on the table when their price is cheaper). This process results in a increased price for products that Americans pay for forever.

Note that Trump wants to impose 20% on ALL imported products from all countries that include Canada and Mexico. For Canada and Mexico, this is a violation of the United States–Mexico–Canada Agreement trade agreement he directed (formally known as the NAFTA agreement).

Note that Harris stated she will utilize “targeted” tariffs that focus on specific products and markets to protect the USA economy and manufacturing (not blanket-wide tariffs on all products from all countries).

Regardless of who (Trump or Harris) imposes tariffs; the USA consumer is the person that actually pays for them – NOT the EXPORTING COUNTRY.

Trump has stated other countries will pay for his social care programs like child-care via tariffs. However, Americans consumers pay the tariff fee. As such, they themselves are funding his programs. Note Trump’s deportation program (of 8-11 million people) will further decimate the hospitality industry, agriculture production, the construction industry, food processing and slaughtering, Maryland crab harvesting, the U.S. fishing industry, manufacturing, and more. Tariffs are paid by USA based consumers. For Trump’s social programs, the US government contributes nothing, it is all on the back of USA based consumers that pay for these programs (instead of the entire tax-paying base).

Note wealthy people benefit the most since they already have the ‘good stuff,’ while the lower and middle class pay for these programs. They cannot even afford to replace their aging or broken appliances (fridges, stoves, dishwashers, washing and drying machines). Again, the rich get richer, and the consumer gets tagged twice (only consumers pay for social programs).

And Finally: Let’s Discuss Reciprocal Tariffs

Reciprocal tariffs (imposed by other countries) will occur in response to Trump’s blanket-wide proposed 20% tariffs on all imported products. The same goes for 60% tariffs on imports from China. All reciprocal tariffs will have a significant impact on many U.S. industries. During Trump’s first term, many countries imposed reciprocal tariffs. This time around, as per recent news, other countries are going to hit back sooner and harder to push Trump to remove his tariffs that Americans pay for.

Below is a list of 10 industries that would be most affected, along with an estimation of the potential damage caused by these tariffs. It is difficult to know the actual dollar cost, but overall, 4 years of these tariff will directly injure the USA by trillions dollars. Indirect damage inflicted on the economy, reduced employment, mucking up supply chains, drastically increasing inflation, reducing the USA GPD and drastically increasing the deficit will be far more expensive than the direct cost of tariffs.

1. Agriculture

-

- Impact: The U.S. exports a significant amount of agricultural products, including soybeans, corn, wheat, pork, dairy, and poultry, to countries like China, Canada, Mexico, and the European Union. China is a key buyer of U.S. soybeans.

- Damage: Reciprocal tariffs imposed by the countries above on these products would lead to a sharp decline in exports, with farmers facing lower demand and prices, resulting in revenue loss and farm closures. The soybean industry alone, for instance, lost billions during the 2018 trade war with China.

2. Automobile Industry

-

- Impact: The U.S. exports vehicles and vehicle parts to major markets such as Canada, Mexico, and Europe. Tariffs would reduce demand for U.S.-made vehicles, increasing costs for U.S. manufacturers and causing production cuts.

- Damage: Reciprocal tariffs by the countries above would lower export demand would lead to reduced factory output and job losses in states heavily reliant on automobile manufacturing, such as Michigan and Ohio.

3. Aerospace

-

- Impact: The aerospace industry, led by companies like Boeing, is one of the largest exporters in the U.S., with significant sales in Asia and Europe.

- Damage: If reciprocal tariffs were imposed, U.S. aerospace companies could lose major contracts to European competitors like Airbus, leading to billions of dollars in lost revenue and potential layoffs in the sector.

4. Technology and Electronics

-

- Impact: The U.S. exports a variety of tech products, including semiconductors, software, and consumer electronics. Key markets include China, the EU, and South Korea.

- Damage: Reciprocal tariffs by the countries above would drive up costs and decrease the competitiveness of U.S. tech firms, leading to decreased sales in global markets and a potential shift in supply chains away from U.S.-based firms.

5. Pharmaceuticals and Medical Equipment

-

- Impact: The U.S. is a leading exporter of pharmaceuticals and medical devices, with significant markets in Europe, Canada, and Japan.

- Damage: Reciprocal tariffs by the countries above on these goods would increase the cost of U.S. medicines and equipment abroad, making them less competitive and reducing exports, especially in price-sensitive markets.

6. Chemicals

-

- Impact: The U.S. chemical industry, which exports petrochemicals, plastics, and other chemical products, would likely be hit hard by reciprocal tariffs, particularly in markets like China, the EU, and Latin America.

- Damage: Increased tariffs by the countries above would reduce export demand and lead to production cuts, negatively impacting jobs in states like Texas and Louisiana, which are hubs for the chemical industry.

7. Machinery and Equipment

-

- Impact: Heavy machinery, such as agricultural, construction, and industrial equipment, is a key U.S. export, with major destinations including China, Canada, and Europe.

- Damage: Reciprocal tariffs by the countries above would lead to a reduction in demand for U.S.-made machinery, resulting in production slowdowns, layoffs, and lost market share to international competitors like Germany and Japan.

8. Oil and Gas

-

- Impact: The U.S. exports significant amounts of oil, natural gas, and refined petroleum products to countries like China, Mexico, and Canada.

- Damage: Reciprocal tariffs by the countries above would make U.S. energy products more expensive, leading to a drop in demand from key buyers. This could force U.S. producers to reduce output, especially in the shale industry, causing economic disruption in energy-dependent regions like Texas and North Dakota.

9. Textiles and Apparel

-

- Impact: The U.S. exports high-quality textiles and apparel to markets in Europe, Canada, and Mexico.

- Damage: Reciprocal tariffs by the countries above would reduce demand for U.S.-made textiles, especially in fashion-forward markets like Europe, leading to job losses in U.S. textile manufacturing and reduced sales for brands reliant on exports.

10. Food and Beverage Products

-

- Impact: U.S.-based food and beverage companies, including producers of processed foods, wine, spirits, and other products, export extensively to global markets.

- Damage: Reciprocal tariffs by the countries above would lead to reduced exports and higher costs for U.S. food and beverage products abroad, decreasing their competitiveness and leading to a potential decline in sales and profits for companies that rely on international sales.

Estimated Economic Damage:

The total economic damage across these industries could amount to billions of dollars in lost exports, reduced production, and potential layoffs. For example, during the 2018 – 2019 trade war with China, U.S. exports to China fell by more than $10 billion, particularly in agriculture and technology sectors. The damage from new reciprocal tariffs could be even more significant due to broader trade restrictions and the inclusion of all products from all countries by Trump. The longer-term impact could be the erosion of U.S. market share in key global markets, as competitors from Europe, Asia, and Latin America capitalize on the tariffs to expand their presence.

This would also strain U.S. companies’ global supply chains and reduce the competitiveness of U.S.-made goods in international markets. The resulting economic contraction could affect jobs, wages, and overall economic growth, particularly in states reliant on export-heavy industries.